Cracking the Code on Environmental Markets: Adding Voluntary Carbon Credits to Regulated Water & Biodiversity Credits in the US

The recent interest in carbon crediting has highlighted inherent challenges in natural capital offset markets (e.g., markets that protect & manage a forest or wetland for environmental benefits offsetting impacts elsewhere). Ensuring that investments in offsets lead to quantifiable, additional improvements toward sustainability goals is challenging. Yet, I and many believe offset markets are a critical tool needed to direct economic activity to address climate change, the water crisis and extinction of species.

With carbon, finding enough projects to supply credits to meet the demand of climate mitigation is expected to be a significant challenge (McKinsey). At the Nectar Exchange we have been addressing this challenge by evaluating the possibility of integrating voluntary markets for carbon with regulated offset markets for water quality and biodiversity in the US. It’s very possible – the trick is ensuring carbon benefits are additional to the benefits for water quality and biodiversity.

Regulated offsets under the Clean Water Act (CWA) and the Endangered Species Act (ESA) represent roughly one million acres of protected areas in the US based on the RIBITs website – the repository for available credits and past transactions for wetland, stream, and species mitigation credits. Importantly, not all the acreage associated with providing wetland, stream, and species credits actually count as credits. For example, the property boundaries that include a wetland credit project might also include some upland forest areas. And stream and wetland credit areas often come with farmlands. Thus, there is an opportunity to decouple lands dedicated to wetland mitigation from unencumbered lands that could be sold in a traditional real estate market, or with carbon finance, restored to maximize climate mitigation potential. Jim Bergan with Delta Land Services calls these “stranded assets”, because not all lands acquired for wetland mitigation purposes qualify for mitigation because those lands do not meet the standards set by offset or mitigation banking program. By decoupling or separating areas based on environmental values we can avoid stacking ecological credits, which leads to a net decrease in environmental values.

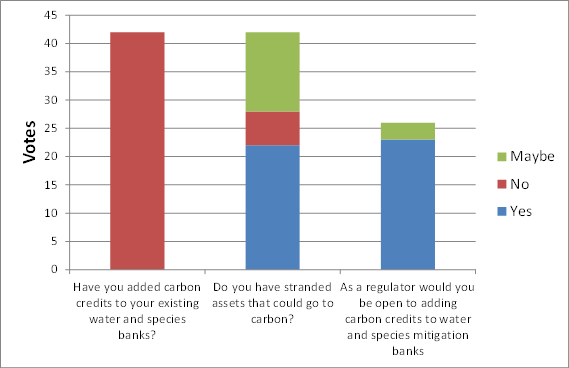

Adding carbon credits to areas already studied and/or managed for natural resource values could be an effective way to mobilize additional carbon and provide data needed to ensure rigorous market outcomes. Maybe we could find 100,000 acres across the US associated with regulated water and biodiversity markets that could generate carbon credits? This would require a new level of cooperation among investors, land owners, and regulators. The Nectar Exchange was fortunate to connect with investors, land owners, regulators, and environmental consultants at the recent National Mitigation and Environmental Markets Conference in Jacksonville, FL. We presented barriers and opportunities associated with the possibility of adding voluntary carbon credits to wetland, stream, and species mitigation banks in the US compliance market. We surveyed the audience about our proposition. Asking, 1) If they have already added carbon credits to their wetland, stream, or species crediting projects? 2) If they have stranded assets that could go toward carbon, and 3) If, as a regulator under the CWA and ESA, would they be open to adding carbon credits? The results highlight what we believe is a significant, untapped opportunity in environmental markets.

I was a bit surprised that no one has yet added carbon credits, as folks within the community have certainty discussed the idea in the past. Also interesting is that the majority indicated that they have stranded assets associated with water and species credit projects. But, a significant portion was unsure. This result highlights the need for programmatic guidance to integrate these markets – criteria for identifying possible carbon assets that are additional to water and species benefits needs to be made clear. And, finally, it was very encouraging to see that regulators responsible for upholding requirements of the CWA and the ESA were overwhelming supportive of adding carbon credits to the projects they oversee. Granted, we did not sample an unbiased group – as we presented in a session on “Multi-Benefit Banking”, but it highlights a pathway for improving the effectiveness of markets for sustainability.

This work is ongoing and a white paper is forthcoming with greater scientific and policy detail. If you would learn about opportunities to participate please reach out to The Nectar Exchange (info@nectarex.org). We’d like to thank Doug Lashley of GreenVest, LLC and Westervelt Ecological Services for their support.

Doug Bruggeman, PhD Executive Director